Table of Content

This may go when there are only a few employees, however it could possibly typically take more time and increases the possibility of error. Given how involved the process is, many companies select to both outsource the method or use a web-based payroll service. If your graphic design company largely employs freelancers or your construction enterprise works completely with roofing contractors, you don't need a full-fledged on-line payroll plan . You want one thing easy like Square Payroll's contractor plan, which has no base fee—instead, you pay just $5 a month per contractor.

This ensures that all needed knowledge is out there during your first payroll period using iComp Payroll & Human Resource Services. Square provides employee benefits inside the Benefits tab of your online Payroll dashboard. For smaller companies with limited budgets, Payroll4Free can be a lifesaver. If you completely will need to have tax reporting and remittance, Payroll4Free presents complete tax service for $15/month.

Timetrex: Greatest Time Tracking

Additionally, other opponents have separated employees’ info into completely different tabs to ease the initial creation and subsequent edits. Therefore, your Square Payroll companies are not instantly accessible. For those hiring self-employed staff, there's additionally the Contractor plan at $6/month that may make you happy. For these paying child assist or wanting to give money to charity, Gusto turns out to be useful. Through the website, there could be the option of deducting money immediately from the payslips for focused liabilities corresponding to donations to charity, payment of child support and even automotive mortgage reimbursement.

Based on the knowledge you’ve entered about every employee, your software will calculate how much tax to withhold and the way a lot to pay your workers. If your staff have direct deposit, then your payroll service will provoke a switch out of your bank account to theirs. Your payroll company should have already got safety measures in place when working with confidential firm data. Examples of necessary knowledge embrace personal worker information, your business’s financial institution accounts, and other important information that pertain to your company. Your payroll company should take confidentiality procedures very seriously to protect your corporation and your employees. The course of for paying and submitting quarterly estimated taxes is much like filing an end-of-year tax return.

What's The Best Sort Of Payroll System For A Small Business?

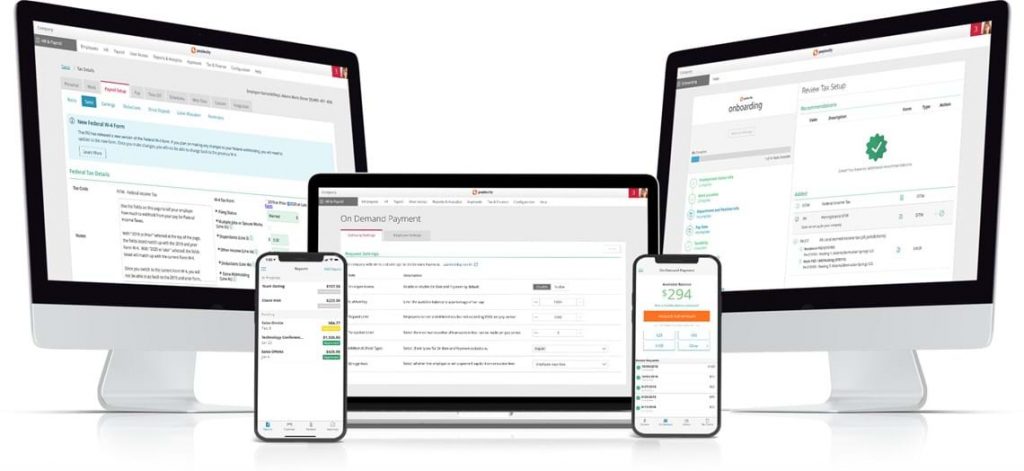

Learn the way to get set up, pay your staff, find HR assist and benefits, and sync with accounting so you'll find a way to manage every little thing in a single place. Approve payroll when you’re ready, access built-in worker companies, and handle every little thing in one place. Let me simply take a moment to say that the PayUSA web site appears prefer it was constructed on the flip of the century. I’m sure they’re one of many on-line payroll companies that get little business from the web. That apart, it was based in 1969 and has a solid popularity in the payroll business.

As such, the most effective payroll software in your small business should be easy, cost-effective and scalable, so it could develop with your business. These are some of the best payroll solutions that meet these requirements for small businesses. PayChex is right for growing small firms since the basic month-to-month plan offers more advanced options than its rivals. Besides, you can even upgrade your subscription later to PayChex Flex plans to get dedicated payroll agents and cell app access. This will prevent the trouble of dealing with authorized cases and the prices that come with them. While using a payroll firm, you'll not have to fill tax documents for workers as unlike for accountants, it forms part of the service offered.

Adp Run

Besides, your payroll accounts ought to be secured due to their connections along with your bank accounts. ADP TotalSource updates their security system regularly to prevent any breach from cyber attacks. Make certain your payroll service company has a buyer care group that will information you thru the immersion process and answer your questions for years to come. Gusto and PayChex provide dedicated payroll specialists that help you in your issues.

The firm also supports international client transactions via its collaboration with Globalization Partners. A 24/7 customer service is out there by way of stay chats or phone calls, you get quick and efficient replies in case of any problems. For Paychex Flex customers, the company provides a devoted payroll specialist to assist with any issues. The cloud-hosted software program has intuitive dashboards that can be accessed from any internet browser. From the dashboard, you are notified of the due date for the following payroll and provides direct access to different options, including payroll stories. It supplies complete employees' compensation, benefits, and PTO support, and integrates seamlessly with main accounting purposes such as Xero and QuickBooks.

Be A Part Of Our Greater Than 730,000 Prospects And Get Assist Managing Hr, Payroll, And Benefits

Whether you've one employee or a hundred, you’ll must course of payroll to ensure they receives a commission accurately and that correct records are kept. Deluxe offers a selection of services to companies, including advertising and enterprise growth, in addition to payroll and HR providers. Paychex is a payroll and HR service supplier for businesses of all sizes.

With its proprietary cloud platform, CloudPay stands out from the competitors with its payroll processing throughout 130+ nations. Multinational organizations can use CloudPay for an adaptable and accurate payroll solution that covers any legislative changes. You can even decrease whole payroll processing time and errors with CloudPay.

To get our rankings, we in contrast every state’s average accounting salary to the state’s overall wage. —so no matter where you live in the US, it’s safe to say that being an accountant pays off. If you need your taxes automated otherwise you're a family enterprise, we recommend SurePayroll. Houzz Pro makes software program designed to make working your business easier.

The worst part is that it is just one factor of a rising business enterprise, whether or not online or offline. Payroll is an important part of running a enterprise, however it can be so challenging to do. The world could be a a lot more comfortable place if you could simply signal checks in your workplace and hand them out to people one by one. They anticipate to owe more than $1,000 in taxes when the end-of-year return is filed. Make deposits to the appropriate tax companies according to the calculated or assigned frequencies.

OnPay presents a single plan, with pricing for the plan at present running $36/month, plus a $4 per employee fee. All options, together with HR and full help choices, are included within the price. While most payroll suppliers offer similar companies, in some instances those providers could additionally be included in the base price, whereas in different instances, they are obtainable at an additional value.

While it doesn’t have as many features as a few of the different payroll platforms here, it’s still probably the greatest payroll providers on the market. Many customers really feel like Wave was not very helpful after they called into the group, but most reviews appear to be related to their funds product. For help, they provide customers the chance to submit a support ticket, chatbot, stay chat, and a assist heart with articles and tutorials.

You can get entry to the information to view invoices, have a look at payroll reports, communicate with staff and so on. Employees can on their aspect see their vacation and sick leaves, benefits data and work hours calculated for their salaries. Additionally, small firms can benefit from third-party advantages administrators that allow you to handle employee’s retirement plans and medical insurance.

No comments:

Post a Comment